TRX Price Prediction 2025: Technical Setup and Market Factors Analysis

#TRX

- TRX trades above 20-day MA but faces Bollinger Band resistance at $0.3578

- MACD shows improving momentum despite negative readings

- Strong network fundamentals contrast with bearish market sentiment

TRX Price Prediction

TRX Technical Analysis: Testing Key Resistance Levels

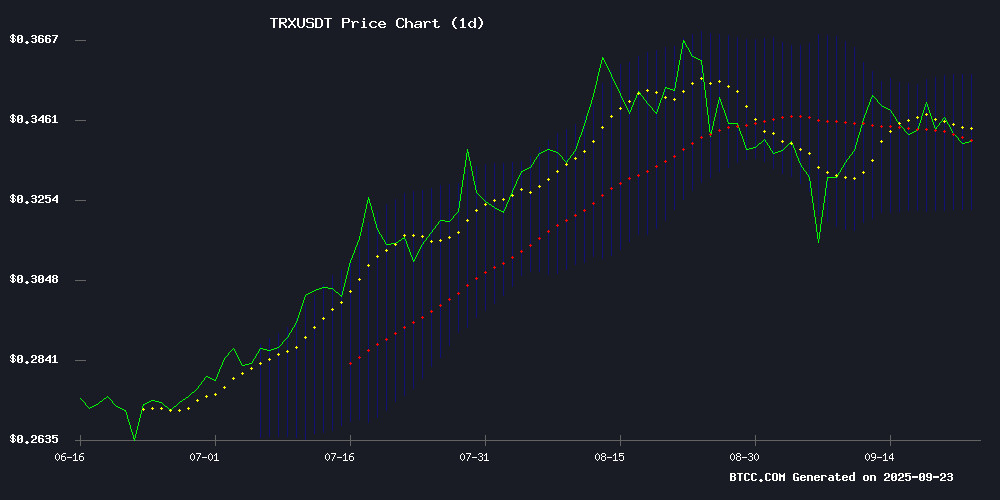

TRX is currently trading at $0.3413, slightly above its 20-day moving average of $0.34042, indicating potential short-term bullish momentum. The MACD reading of -0.007411 remains in negative territory but shows improving momentum with the histogram at -0.004497. Bollinger Bands position the current price between the middle band ($0.34042) and upper band ($0.35780), suggesting room for upward movement if bullish pressure continues.

According to BTCC financial analyst Mia, "TRX's position above the 20-day MA while testing Bollinger Band resistance creates a critical technical juncture. A sustained break above $0.3578 could trigger further gains toward $0.37."

Market Sentiment: Mixed Signals Despite Network Strength

Recent news highlights TRON's strong network activity failing to translate into price appreciation amid broader market pressure. The expansion of crypto futures trading by PrimeXBT adds 101 new altcoins, potentially increasing overall market liquidity but creating competition for investor attention.

BTCC financial analyst Mia notes, "While TRON's fundamental network usage remains robust, the current bearish market environment is overshadowing these positive metrics. Strategic portfolio diversification becomes crucial in such conditions."

Factors Influencing TRX's Price

From Presale To Profit: Building a Winning Crypto Portfolio Through Strategic Diversification

Successful crypto portfolio construction hinges on calculated diversification across presale opportunities. The presale market operates on power law dynamics—where a single high-performing asset can offset multiple underperformers, but only if investors properly manage risk through stratification.

Effective diversification spans five dimensions: sector exposure (infrastructure, DeFi primitives, consumer/gaming, and real-world assets), blockchain ecosystems (Ethereum/L2s, Solana, modular stacks, appchains), investment timing (private rounds, public entries, early listings), market capitalization tiers (micro-cap to large-cap), and token economic models (utility vs governance, fee-sharing vs emissions).

A sample portfolio framework allocates 25% to micro-cap presales (8-12 positions) for asymmetric upside, 30% to small-caps (6-10 positions) for balanced growth, 25% to mid-cap early listings (4-6 positions) for liquidity advantages, 10% to large-caps for stability, and maintains 10% cash reserves for market dislocations.

TRON’s High Network Activity Fails to Boost TRX Amid Bearish Pressure

TRON's network demonstrates robust activity with 9-10 million daily transactions and $25 billion in USDT transfers, yet TRX price struggles. The altcoin dropped 3.03% daily and 3.96% weekly, trading at $0.336 amid sustained selling pressure.

CryptoQuant data reveals a 20% increase in TRON's 30-day moving average for transactions since January, signaling growing adoption. Stablecoins, particularly USDT, dominate volume with $25 billion in transfers, per Artemis metrics.

Spot Taker CVD shows a -35 million Delta, indicating persistent seller dominance. Unless market sentiment reverses, TRX faces potential downside toward $0.32 despite strong fundamentals.

PrimeXBT Expands Crypto Futures with 101 New Altcoins

PrimeXBT has aggressively expanded its crypto derivatives offerings, adding 101 new altcoin futures contracts paired against USDT. The move positions the multi-asset broker as a comprehensive platform for speculative trading across LAYER 1/2 protocols, DeFi, meme tokens, and emerging sectors like AI and gaming.

The rollout features competitive trading conditions including leverage up to 1:500 for Bitcoin and 1:150 for altcoins, with fees starting at 0.045%. PrimeXBT's tiered risk framework incorporates cross/isolated margin options and benefits from deep liquidity sourced from top exchanges.

Notable additions include trending tokens like WLFI, alongside categorized access to metaverse, NFT, and infrastructure projects. The expansion reflects growing institutional demand for sophisticated crypto derivatives products beyond just BTC and ETH exposure.

Is TRX a good investment?

Based on current technical and fundamental analysis, TRX presents a mixed investment case. The technical setup shows potential for short-term upside with price trading above key moving averages, while fundamental network activity remains strong despite market headwinds.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $0.3413 vs $0.34042 | Bullish |

| MACD Position | -0.007411 | Neutral/Bearish |

| Bollinger Band Position | Middle to Upper Range | Moderately Bullish |

| Network Activity | High | Fundamentally Positive |

BTCC financial analyst Mia suggests, "Investors should consider TRX as part of a diversified portfolio rather than a standalone bet, with careful attention to the $0.3578 resistance level."